Flat roofs may not be the flashiest part of a property, but when they fail, they’re often the most expensive to deal with.

But what makes them so disruptive isn’t just the cost—it’s the timing. Most replacements aren’t planned. They’re urgent, reactive, and forced into budgets meant for entirely different priorities.

For industrial and commercial property owners, a capital expenditure of $200,000 or more can hit without warning. And when it does, it pulls resources away from higher-value investments. Tenant upgrades get paused. Energy efficiency projects stall. Growth strategies are delayed.

A failing roof can wipe out your capital reserves in one move—but it doesn’t have to.

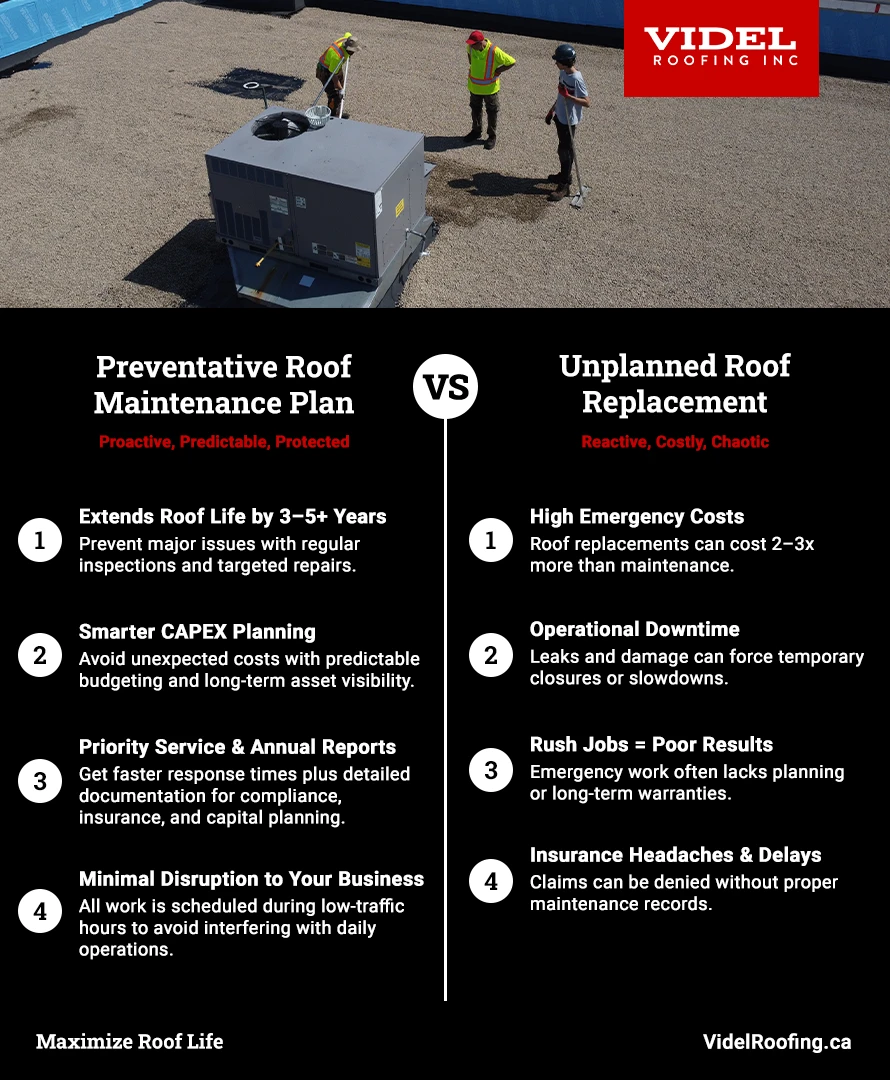

In this article, we’ll show how a structured roof maintenance plan can:

- Defer major capital expenditures without compromising performance

- Improve your ability to forecast budgets and CAPEX planning

- Preserve liquidity so you can reinvest in higher-value opportunities

What Is CAPEX Planning and How Exactly Does Roofing Maintenance Help?

Capital Expenditures—or CAPEX—are big-ticket investments that improve or extend the value of your property. Think structural upgrades, system replacements, or large-scale improvements that don’t just maintain the building, but materially impact its lifespan and performance.

These costs are not part of your day-to-day operations. That’s where Operating Expenses (OPEX) come in—routine spending like inspections, service calls, or minor repairs.

- OPEX = routine

- CAPEX = disruptive

And among all CAPEX planning items, roofing stands out for both its cost, difficulty, and unpredictability. In general, a full commercial or industrial roof replacement can easily exceed $200,000, depending on size and complexity.

But it’s not just the price tag that creates pressure—it’s the fact that most replacements happen out of sequence. They hit when you’re not expecting them. When the budget is already spoken for. When your capital is tied up elsewhere.

In a perfect world, CAPEX can be forecasted years in advance, with budgets built around strategic goals. But roofing doesn’t always play by those rules.

A roof leak can accelerate a five-year plan into a five-week scramble. And in commercial and industrial buildings, the stakes are high. A flat-roof system can run into the hundreds of thousands, disrupting not just cash flow—but opportunity cost.

That unpredictability is what makes roofing such a critical part of CAPEX planning. The costs are substantial. The timelines are volatile. And the consequences of poor timing ripple across your entire portfolio—from delayed upgrades to stalled expansion efforts.

Which is why understanding the true condition of your roofing system—not just its age—should be step one in every long-range budget conversation.

The Financial Risk of Premature Roof Replacement

Industry data suggests that more than 80% of commercial flat roofs are replaced prematurely.

In our 25+ years of roofing, we’ve seen the same trend here in Ontario. Property owners replace roofs far too early—not out of negligence, but because they’re trying to protect the building. The problem is, they’re burning through capital that could be preserved.

These replacements aren’t happening because the roofing systems have failed completely. They’re happening because a leak appears. Or a patch job doesn’t hold and without a trusted second opinion, assumptions take over.

And what’s worse? Too many roofing contractors are quick to recommend full replacement—because that’s where their margin is. Because not every company profits from ongoing service or long-term planning.

At Videl Roofing, we’ve built our family-run roofing business on something different: keeping property owners informed, protected, and in control of their capital.

Here’s what we often see when replacements are pushed too early:

- No core testing or condition reports—just a visual inspection and a quote

- No cost-benefit analysis of repair vs. maintenance vs. replacement

- No financial modeling to help decision-makers understand long-term impact

- Little incentive to explore alternatives when replacement is the most profitable option

- Pressure tactics disguised as urgency, leaving little time to assess options

When you replace a roof before it’s necessary, you’re locking up hundreds of thousands in working capital. That’s capital that could have been preserved, redirected into property upgrades, or used to strengthen your portfolio.

Of course, the goal isn’t to avoid replacement forever. But with accurate assessments, performance data, and a clear understanding of the system’s remaining life, you can make the right decision at the right time—for your building, your tenants, and your bottom line.

“80% of Commercial & Industrial Flat Roofs Are Replaced Too Early”

Industry data shows the majority of commercial roofs are replaced before it’s truly necessary—costing property owners hundreds of thousands in avoidable capital loss.

Most replacements happen not because of failure, but because of fear, assumptions, or pressure from contractors who profit from urgency—not long-term strategy.

Use Our ROI Calculator to See If a Roof Replacement Really Makes Sense

Get a data-backed cost comparison between repair, maintenance, and replacement—so you can protect your reserves and plan CAPEX with confidence.

How Maintenance Defers CAPEX and Protects Your Liquidity

When you’re forced to replace a roof unexpectedly, the costs don’t just hit your budget. They disrupt your planning window, tie up liquidity, and pressure your reserve strategy.

Maintenance doesn’t eliminate those costs, but it gives you the power to time them strategically, align them with lease cycles, and keep your capital working longer.

That’s the real value behind a deferral strategy.

Case Study: Roof Replacement Financial Planning for a Toronto Industrial Property

To see how roof maintenance ties into capital planning, let’s walk through a real-world example.

In this scenario, we’ll consider a 20,993 sq. ft. industrial building at 20 Mid-Dominion Acres in Toronto that is currently listed on Realtor.ca for $10.7 million. The listing mentions the facility has been well maintained—but let’s flip the story.

Let’s assume the building hasn’t had a structured maintenance program in place. There’s no formal documentation for roof inspections or servicing. The current roof is estimated to be 15+ years old, and aside from the occasional patchwork, it hasn’t seen proactive care.

Now, you’re the prospective buyer—or the asset manager responsible for planning future capital improvements.

Why This Matters:

Industrial tenants don’t need luxury finishes. What they do need is a roof that protects their equipment, materials, and operations. A compromised roof can halt production, damage goods, and put tenant retention at risk.

According to a report by Toronto Regional Real Estate Board (TRREB), the average industrial lease rate in Q3 2024 reached $17.03 (per sq. ft.). That means a single month of vacancy in this building would cost the following:

- 20,993 sq. ft. × $17.03 ÷ 12 = $29,736/month in lost revenue

And if a roof issue forces your tenant to pause operations—or relocate—you’re not just losing rent. You’re absorbing a deeper financial hit that cascades through your lease obligations and reserve planning.

Breakdown of Costs and Capital Requirements for Flat Roof Replacements

Flat roof replacements in Ontario generally fall between $8 and $14 per sq. ft., depending on condition, removal requirements, insulation upgrades, and system selection.

For this property:

- Low estimate (basic overlay): ~$168,000

- Mid-range (full replacement): ~$210,000

- High end (tear-off + upgrades): ~$293,000

Add reserve funding for:

- Vacancy buffer (2 months): $60,000

- Emergency repairs: $30,000

- Operating cushion: $50,000

➔ Total recommended reserve: ~$350,000

Based on our experience working with property investors and portfolio owners, this is typically a realistic cash requirement for an owner walking into this property without knowing the roof’s true condition.

Videl’s Advice: Use a Deferral Strategy to Preserve Your Capital and Buy More Time

Now, let’s say the roof is still performing adequately, despite its age. It’s weathered, patched in a few areas, but not leaking or showing structural failure. Rather than rushing into a six-figure replacement, you commit to a preventative maintenance plan, investing $10,000 annually.

Over the next five years, here’s what that looks like:

- Total spent on maintenance: $50,000

- Capital preserved for higher-yield investments or strategic reserves: ~$160,000

But the benefits extend well beyond cost savings. That $160,000 in preserved capital could be:

- Reinvested into tenant improvements or energy retrofits

- Used to build a more strategic reserve for the eventual replacement

- Leveraged for new financing or used as a buffer against interest rate volatility

- Deployed across your portfolio where it generates real return

You also gain:

- Time to align roofing work with tenant rollover or lease-end

- Flexibility to manage cash flow more predictably

- Continuity of operations for tenants who rely on your building to run their business

With the right maintenance plan, you’re effectively buying 5+ years of time while keeping capital liquid while your asset produces ROI.

Most importantly, you’re not reacting to urgency—you’re leading with foresight and financial discipline. You’re making decisions based on real conditions, not assumptions or age alone.

And when the time does come to replace the roof, you’re financially prepared—with less disruption and more options on the table.

5 Canadian Roofing Accidents That Prove Liability Insurance is Essential

5 Canadian Roofing Accidents That Prove Liability Insurance is Essential